BY JOHN D. WILBURN

When discussing gold and silver, a historical perspective is always desirable. Gold has served as money for some 2,600 years, from ancient Hebrew times up until 1933, when the U.S. withdrew gold coins from circulation. Gold has always been desirable for its beauty, rarity, and its resistance to tarnish and corrosion. Kings throughout history have accumulated gold. King Solomon acquired gold, and the “Wise Men” brought gold to Jesus Christ. The quality and value of gold has been trusted like no other commodity. Unlike the history of numerous currencies that have come and gone, there has never been a time when gold wasn’t valuable. All substitutes for gold have led to monetary crisis.

When discussing gold and silver, a historical perspective is always desirable. Gold has served as money for some 2,600 years, from ancient Hebrew times up until 1933, when the U.S. withdrew gold coins from circulation. Gold has always been desirable for its beauty, rarity, and its resistance to tarnish and corrosion. Kings throughout history have accumulated gold. King Solomon acquired gold, and the “Wise Men” brought gold to Jesus Christ. The quality and value of gold has been trusted like no other commodity. Unlike the history of numerous currencies that have come and gone, there has never been a time when gold wasn’t valuable. All substitutes for gold have led to monetary crisis.

Many kingdoms and empires which became pages in history books followed the same pattern of monetary debasement. First, gold is removed from coinage, then silver, leaving copper coins at best. Paper money is the worst form of debasement. Sir Thomas Gresham in 1558 made the classic observation, “Bad money drives out good money.” The money becomes virtually worthless; and once the delusion becomes a reality, panic results in monetary disaster. Germany is a classic example, among many.

Twice in this century the German mark has become worthless, destroyed in 1923 by hyperinflation, and again in 1947. In 1937, Adolph Hitler said, “Our money is not backed by dusty gold bars sitting in bank vaults, but by productivity of the people.” Then years later the mark was worthless. President Jimmy Carter made the same statement in 1977, relative to the dollar! Historically, paper money has been mistrusted, even the American “greenback.”

Greenbacks were issued in the 1860’s as an expedient to finance the Civil War, but inflation soared and gold and silver went into hiding. The “Panic of ’93″ resulted in greenbacks being redeemed for gold. In 1932, greenbacks were distrusted and redemption was so great that the Philadelphia mint struck a record 4,463,000 ten-dollar gold coins. The people were acting to protect themselves against false values and government mismanagement. False values in the 1929 stock market crash proved paper assets could not be trusted.

On March 6, 1933, the U.S. government stopped exchanging gold for dollars (ironically, Adolph Hitler came into power the same day). The reason for demonetizing gold is to expand the money supply in an attempt to increase productivity and wealth. But wealth cannot be printed. In all cases, an expanding money supply leads to inflation, depreciating the currency. The results are rising prices. The products are not changing value, only the currency! Eventually all monies other than gold become worthless or greatly depreciate.

So why do governments abandon gold? Because goods and services can be acquired at the cost of paper and ink! The government produces nothing but war, waste, greed and debt! The government survives because it gives so much of what it doesn’t own. The bureaucrats penalize producers and reward consumers by acting as a distribution center. The government must continually expand taxes, licenses, fees, permits, duties, etc., to finance its give-away programs (and being so generous assures re-election); and if that doesn’t cover the cost, then it runs deficits, borrows money from the Federal Reserve, and sells the debt to the public! The process works as long as there is productivity and confidence in paper money. But sooner or later, productivity declines, inflation soars, the value of the currency plummets, and confidence is shaken. Years of government expansion adds to the cost of productivity through higher taxes, rules, regulations, fees, permits, etc., forcing businesses to close and fueling inflation. And government debt keeps interest rates high, adding to the cost of doing business. It is ironic that high interest rates make the dollar strong; when in reality it penalizes productivity, the solid backing for the currency!

Today the dollar is worth less than ever.

The reason there is a federal debt (or state debt) is that there are too many people getting something for nothing! And deficits are a major contributor to inflation.

How much longer can the government print “prosperity” before hyperinflation results? Or, will the U.S. debt bomb explode first? Total internal U.S. debt can never be paid. Stocks, bonds, life insurance policies and pension plans all could be wiped out! When money is created out of nothing, it can return to nothing!

Gold is still the world’s greatest monetary asset, and central banks hold nearly a third of their assets in gold, because paper assets cannot be trusted. A sudden lack of confidence is the cause of all monetary crises. Higher interest rates can keep a crisis in check, as greed rules over fear. But eventually a debt crisis will lead to a dollar crisis. At some point, confidence in debt will deteriorate, and the Treasury may no longer be able to sell bonds and T-bills, constituting default, and the “full faith and credit” of the U.S. Government will end, and panic will beset the dollar. Panic debt liquidation is the greatest fear.

The 21st century will see more inflation, more debt, and a weaker dollar. Gold is protection from governments who ultimately run massive deficits, create inflation, devalue the currency, all ending in default and bankruptcies. The value of gold remains stable regardless of inflation or deflation. In an unstable world with depreciating paper assets, gold is still the world’s greatest monetary asset!

- Here is where you can buy a sample of natural gold.

- Here is where you can buy a basic gold prospecting kit.

- More about gold

- More about how to prospect for gold

- Schedule of upcoming events

- For a more thorough explanation of gold mining techniques, checkout these informative books and videos by Dave McCracken.

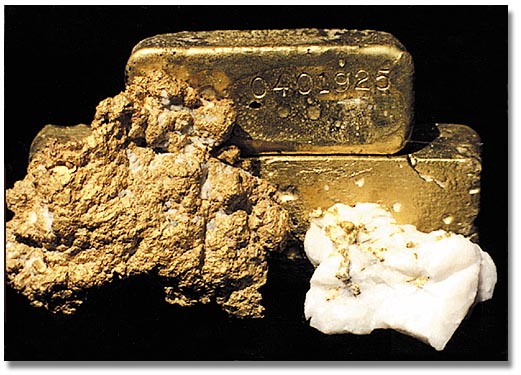

As the earth cooled into a planet, the high specific gravity of gold placed it in the earth’s mantle. Specific gravity is the mass of gold compared to the mass of the same volume of water, or 19.3 times heavier than water. The mantle is the inner layer of molten rock, below the continents and ocean floors. The continents have been moving around over the earth’s mantle for geological ages. At the end of the Cretaceous Period, 65 million years ago, the molten material began to boil and churn in circular currents. As the continents were moved about by the tectonic forces generated by the movement of the molten mantle, there were places where this molten material was pushed up to the surface. With it came the heavy metals, including gold, which was deposited very often in veins in faulted rock or as replacements of other minerals. The minerals that are usually associated with gold are quartz and the heavy metals. Over the course of geologic time, these veins of gold-bearing rock were exposed to weathering and the gold was eroded and transported by moving water.

As the earth cooled into a planet, the high specific gravity of gold placed it in the earth’s mantle. Specific gravity is the mass of gold compared to the mass of the same volume of water, or 19.3 times heavier than water. The mantle is the inner layer of molten rock, below the continents and ocean floors. The continents have been moving around over the earth’s mantle for geological ages. At the end of the Cretaceous Period, 65 million years ago, the molten material began to boil and churn in circular currents. As the continents were moved about by the tectonic forces generated by the movement of the molten mantle, there were places where this molten material was pushed up to the surface. With it came the heavy metals, including gold, which was deposited very often in veins in faulted rock or as replacements of other minerals. The minerals that are usually associated with gold are quartz and the heavy metals. Over the course of geologic time, these veins of gold-bearing rock were exposed to weathering and the gold was eroded and transported by moving water.

picture. Since we suffered from a shortage of gold, France, and Spain to a lesser degree, loaned the Colonies over $20 million in gold and silver. This eventually saved the independence movement, since our Continental dollars were not backed by gold. Our own first major gold discovery would not come until almost three decades later (1799) in North Carolina.

picture. Since we suffered from a shortage of gold, France, and Spain to a lesser degree, loaned the Colonies over $20 million in gold and silver. This eventually saved the independence movement, since our Continental dollars were not backed by gold. Our own first major gold discovery would not come until almost three decades later (1799) in North Carolina. By the end of the first year of the 1849 California gold rush it is estimated that close to 100,000 individuals seeking their fortunes had made it to area diggings. They came from foreign lands as well. In fact 25% of all 49’ers were not Americans. They hailed from as far away as China, Australia, England and France.

By the end of the first year of the 1849 California gold rush it is estimated that close to 100,000 individuals seeking their fortunes had made it to area diggings. They came from foreign lands as well. In fact 25% of all 49’ers were not Americans. They hailed from as far away as China, Australia, England and France. country, the “Welcome Stranger.” Discovered in 1869, it weighed an incredible 2,284 ounces. The “Golden Eagle,” unearthed in 1931, weighed in at 1,235 ounces. More recently was the “Golden Aussie” mentioned above.

country, the “Welcome Stranger.” Discovered in 1869, it weighed an incredible 2,284 ounces. The “Golden Eagle,” unearthed in 1931, weighed in at 1,235 ounces. More recently was the “Golden Aussie” mentioned above.