By Dave McCracken

When dealing with gold, it is important to reach way down inside yourself and decide who you are going to be!

Integrity is a personal matter. We each make our own decisions about how we will relate to others and the world around us. There are not many true saints around. Most of us have limits whereupon weaknesses or flaws in our character allow us to fall from grace (when we do things differently than we know we should).

Most of us are not monsters. So we each place personal limits to which we will not step beyond when it comes to the bad stuff. For example, a person might bend the truth around a bit, but would never steal something that belonged to someone else. Another person might steal small things, but never anything of great value and never from anyone that the person knows. Another person might be willing to pull off any kind of scam to cheat others out of money, but the person would never kill anyone. Perhaps someone in the business of murder would draw the line when it comes to killing someone in his gang or family. We each set our own upper and lower limits by the internal decisions that we make. Then, life-situations push us up and down against these limits, and we are tested.

There are few things in life that will test your limits more strenuously than natural, beautiful gold. So it is wise in the beginning to do some introspection and decide where your personal limits are going to be.

Anyone who believes they are not going to be personally tested by gold has just not found enough of it yet!

Anyone who believes they are not going to be personally tested by gold has just not found enough of it yet!

I am not a saint, either. So I instinctively knew when I was just starting in gold prospecting that I had some internal decisions to make. Since I really enjoy the activity, and wanted to carve out a place for myself in this industry, I made my decisions early on that this was one area of my life that I was not going to mess up for myself through bad business dealings or unethical behavior. At least in this one area, I decided that I was going to try and do everything the right way.

Therefore, I personally never agree to a percentage deal with partners or property owners that I do not fully intend to pay. As part of this, during the time it is in my possession, I never allow myself to get attached to that portion of the gold recovery which belongs to others.

Over the years, I have run across people on a regular basis that love gold so much, that I just can’t trust them with it. Gold is great. But you cannot let it take you completely over. In the end, it is a personal decision how deep you are going to allow yourself to get sucked in by gold. Moderation is the key to this.

Any game or activity must follow an agreed-upon set of rules, for which there is a certain amount of freedom to act within. These are the same rules that are being formed up when a business agreement is made with partners or the owner of a mining property.

You cannot really win a game through cheating. To knowingly break the rules of a game so that you can win, is to admit that the game – by the rules – is above your ability to play. A person has actually already lost the game at the point where he or she needs to cheat or change the rules without the agreement of the others who are playing.

When a person finds him or herself making all sorts of justifications to reinforce some unethical behavior, the right and wrongness of the action must already be in question in that person’s own estimation. It is the recognition of questionable behavior that prompts all the justification

This discussion is not about how other people feel about you. It is about how you see yourself. I am talking about the internal mechanisms that people use to bury their own ability to see the truth in things.

Natural ability and intelligence fundamentally comes down to being able to recognize the differences between things and to be able to act upon the differences. Whatever that quality is inside of you that can tell the difference between black, grey and white, or the differences between a hundred different shades of gray, cannot be separated from that part of you that is able to see the differences between right and wrong, or the many different shades of right and wrong. We are talking about the same thing.

A floor cleaner can tell the difference between a dirty floor and a clean floor. If he is good, he can tell the difference between a clean floor and a sparkling floor. And by being able to differentiate in this way, he will be able to learn exactly how to keep the floor sparkling. That is what makes him a good floor cleaner. This ability stems directly from the ability to see differences and the willingness to act upon them.

A gold dredger must be able to tell the difference between hard-packed material, and slightly-less hard-packed material. You need to be able to recognize when different layers change. You need to be able to see even the slightest differences in the amount of gold that is present. Prospecting is entirely about recognizing and comparing the differences that you see as samples are dredged into the streambed. Recognizing the differences, and then acting upon them, can mean the difference of finding a rich pay-streak, or missing it entirely even when all the signs of its presence were right there in front of you. There are hundreds of tiny signs and things to see and know to succeed well in this field. The good gold dredger sees many of these little differences and is able to follow up on enough of the right ones to strike pay-dirt often enough to make the activity worthwhile. This is ability that I am talking about, and it depends entirely upon your capacity to tell the differences between things and act upon them.

Personal integrity and intelligence go hand in hand with each other. When you shut down your ability or willingness to recognize the finer shades of right and wrong, you also close off that same part of your ability to see important distinctions that allow you to follow the path of gold into high-grade deposits. Your search for gold through prospecting is really a search for the truth of the way things are. Not the way you want them to be; but the way they really are!

No matter how you try to make yourself feel better about it (justification), when you cheat a claim owner or partner out of that portion of the gold that you have already agreed belongs to him (them), you are burying that priceless part of yourself that can see the truth of things. You are making yourself more stupid!

So the best answer in gold prospecting is to never cheat. The answer is to be very careful to only make deals that you can honor, and find enough gold that you can more than meet your obligations to the others who are involved. People who are good at gold dredging, and at life, do not need to steal from their partners (called “high-grading” in mining terminology) to succeed and do well at it.

You have to kick these concepts around for yourself and figure out where you are going draw your own line. Because, if there is anything in this world that will put your personal integrity to the real test, it is gold! Gold can be very difficult to let go of once it is in your hands. Gold is especially hard to give away when, internally, you do not feel that the recipient really deserves to have what it is coming to him – even if you have agreed to it beforehand. In such a case, with gold, sometimes it might be tempting to not follow through on an earlier agreement. You can find yourself coming up with all kinds of reasons (justifications) as to why you do not need to follow through with the earlier agreements. Justifications can be made to sound very reasonable (to yourself). But if they are that reasonable, why not take them up with the claim owner? Gold is a very tempting substance. You need to be careful to not lose yourself because of it!

I always try and work out a complete deal before I go onto someone else’s mining claim or property. There is much to lose by not doing so. If I cannot come to acceptable terms with a claim owner, it is much better to know ahead of time. There is no scarcity of rich gold-bearing river property around. I stay away from bad deals. This way, I do not put my personal integrity at risk in a gold mining venture.

I also stay away from making deals with bad people. Such people have a severely contagious disease. Take Joe Blow for example, who is doing pretty well in life and making progress towards his goals. Then one day he takes up a partnership with Pete Schmuck, who is obviously a shady character. Let’s say that Joe has established a pretty strong stand on his own morals, so he does not get pulled down into unethical activities by Pete Schmuck. One day, however, Schmuck finally ends up pulling the big con job on Joe Blow – or on Joe’s associates, which is even worse! Joe gets mad and now feels the need to get even, or to stop Schmuck; or if nothing else, to make things right again with his associates – if that is even possible. But before Joe teamed up with Schmuck, he was doing fine and getting along well in life. See what I mean? Cheaters are sick. They are losers. They are dishonest because they are not capable enough to do things the right way.

There is a saying, and it’s a good one: “If you want to fly like an eagle, quit playing with turkeys!”

By Dave McCracken

It would be wise to discuss how you are going to split the costs and rewards with your partner(s) before you strike a rich gold deposit!

There are several good reasons to team up with another person in a gold prospecting or mining program. One good reason is safety. A dredging accident is less likely to be fatal if there are two people on the scene keeping an eye on each other. A buddy is also able to offer a huge amount of assistance when it is time to move gear around during the sampling stages. Still another good reason to have a partner is the emotional support that two persons can give each other when you are just learning to sample.

It is true that two gold prospectors are likely to finish off a pay-streak around twice as fast, with only half as much gold going to each person. But it is also true that two motivated people tend to spur each other on to get more accomplished – as long as both of you are hard workers. It can be much easier to locate the pay-streaks when two people are sampling and seeing it through together. And one other thing: In gold prospecting, there can be some amazingly-good moments which carry an incredible emotional impact – like when a very rich deposit has just been discovered and the first bit of high-grade is being dredged up the suction nozzle. These are experiences which could never be wholly communicated to and understood by most others, so it is nice to experience them alongside someone else.

Most pay-streaks can be dredged up, or dug up, with two people working side by side. To try and mine pay-streaks with more than two dredges at once can become unwieldy. It can be difficult to mange a third dredge (knocking out plug-ups or whatever) when it has other dredges tied to both sides of it. Under the majority of conditions, two-person teams are better than larger-sized group dredging programs. By that, I mean that the individual prospectors are likely to end up recovering more gold for their effort.

PARTNERSHIP DEALS

There are several ways that two people can team up in gold prospecting or mining: They can form a full partnership and find, recover and split up all the gold equally between themselves. They can form a more limited partnership, helping each other to locate the deposits; and then clean them up together, with each person keeping what gold he or she recovers. Or, they can form an even more limited association whereby they agree to help each other move gear around when needed, with each person finding and recovering his or her own deposits. Each of these different arrangements has its own advantages and disadvantages, and each can be most-optimally used under different sets of circumstances. It is good to be able to shift from one of these arrangements to another, depending upon what the situation is.

Teaming up with one other person on a full 50/50% partnership basis is done best when both partners are of relatively equal mining and sampling ability, when both are willing to put equal amounts of time and energy into the operation and when both have about an equal share of financial investment into the program. Just by the nature of the way gold affects people, if the gold being produced by an operation is going to be equally split up, then the amounts of input into the operation should be reasonably equal, too. Otherwise, uncomfortable feelings can begin to separate the partners.

Teaming up with one other person on a full 50/50% partnership basis is done best when both partners are of relatively equal mining and sampling ability, when both are willing to put equal amounts of time and energy into the operation and when both have about an equal share of financial investment into the program. Just by the nature of the way gold affects people, if the gold being produced by an operation is going to be equally split up, then the amounts of input into the operation should be reasonably equal, too. Otherwise, uncomfortable feelings can begin to separate the partners.

The more gold that is being recovered, the more that the inequities tend to express themselves. This can happen in varying amounts, depending upon the relationships, how much gold is being recovered and how far the exchange of time, financial investment and physical work has gotten out of whack between the people involved.

I was dredging on a 50/50% deal with another dredger in a moderately rich pay-streak not too long ago. We each had our own dredges in the pay-streak side by side, but I was recovering two to three times more gold every day than he was. This can happen once in a while in a pay-streak when one guy will uncover a richer section of pay-dirt, but this was happening every single day!

The water was very cold, and it was towards the end of a long and hard-working, successful season. We were both kind of burnt-out, but I had set a quota for myself to put another pound of gold into my poke before knocking off for the season. The gold was there; I just needed to dredge it up! My buddy needed the gold too, but he was not as motivated as I was. The only reason why he had not called it quits for the season, he said, was because I hadn’t.

One day we sat down and I told him that I only wanted one more pound before ending off; and that I wanted to go after it on my own – keeping what I recovered, and allowing him to keep what he recovered. Since the pay-streak was just as rich on his side as it was on mine, and since he was an ethical man and close friend, he could see the fairness in what I wanted to do. What I wanted was to change the nature of our partnership. So he agreed, and we started dredging side by side, each of us keeping what gold we recovered. Well, you will never guess: I started recovering a little more gold than I already was, and my buddy started recovering about three times as much gold as he was before! The pay-streak did not get any better over there. We just changed a working agreement. This is fruit for thought.

GRUBSTAKING

There are various ways that different people can contribute to a prospecting or mining program to keep the input relatively equal. One person may have the equipment and the experience, while another person might have the money to finance the operation. Full partnerships under these circumstances can be made to work more often when both parties are equally willing to put time and physical energy into the operation.

The kind of deals where one partner is going to put up the money and end up with half the gold, while the other person does all the work, generally do not turn out as well. Be careful about agreeing to a partnership on an equal basis with somebody who is not going to put in his equal share of mining alongside of you. While these deals seem fine in the beginning, they can become unfair to the guy doing all the work once a rich deposit is located.

The kind of deals where one partner is going to put up the money and end up with half the gold, while the other person does all the work, generally do not turn out as well. Be careful about agreeing to a partnership on an equal basis with somebody who is not going to put in his equal share of mining alongside of you. While these deals seem fine in the beginning, they can become unfair to the guy doing all the work once a rich deposit is located.

Since you can really only put in so many hours a day at mining or prospecting, there is still plenty of time left over to clean-up, cook, repair gear, and do the other necessary things around camp. So there is no good reason to give an equal share of the recovery to someone else to do these things for you (unless it is your spouse or mother). If you do, you will be feeling the pain out of your own pocket once you get into a high-grade gold deposit.

Grubstake deals seem to work out better when the percentage to the silent financier is kept down to about ten percent or less of the gross find. Unless it means not going at all, you should try and avoid having to give any more royalties (especially of the gross recovery) away than you positively have to. As a matter of business, the larger cut of the pie you must give to others, the more lower-grade pay-dirt you will have to pass up that would otherwise be acceptable mining under other circumstances.

Unless some very rich area has already been located and just needs to be dredged or dug up, an absent financier and the property owner will likely make more gold in the long run if the amount of gold the miner needs to pay out is not kept down to a minimum reasonable percentage of the recovery. It is not in anyone’s interest for the miner to go broke, especially when a more fair distribution of recovery will allow a gold deposit to be mined up! In this light, it is unwise for the property owner or grubstaker to require more than a small percentage of the gross recovery.

I met up with a guy in Alaska who had agreed to pay a grubstaker 50% of his gross recovery, because the grubstaker had sent along enough groceries to last the dredger all season. Now let’s see; that’s 50% to the grubstaker, 10% to the claim owner, and the dredger still had to pay his own travel expenses, fuel and other operating expenses and repairs. How was he going to make any money for himself? He didn’t, and neither did the grubstaker! And the worst of it is that he was into a very nice pay-streak, which he had to leave behind for someone else to dredge up. See how this works? Unreasonable deals also plant the seed of dishonesty, where the only way the miner can make the deposit pay for himself, is to cheat his partners. I have talked about the challenges of gold and integrity in a different discussion.

In some partnerships, one person may receive a higher percentage of the gold recovery because he or she has invested more into the program than the other. Regardless of the agreement, and how right it is, when split-up time comes, and one person’s pile is larger than the other’s pile, both people are likely to feel a uncomfortable about it. As an example, doing one of my friends a favor a few years ago, I invited him to dredge with me on my 8-inch dredge, in a rich gold deposit I already had discovered through previous investment of my own, on a mining property which belonged to me.

A) Ten percent off the top to whoever owns the dredge (someone had to put out the money to buy it and make it available).

B) Ten percent off the top to whoever owns the mining property (someone had to put out the money to buy it and make it available).

C) Five percent as a finder’s fee to whoever discovered the gold deposit (as long as it is really there).

Since we were buddies, and I already was concerned with the potential hard feelings that could arise when it was time to split the gold, I chose to forgo the 5% finder’s fee, even though I had invested months into locating the rich deposit in the first place. We had agreed that we would split the operating costs. We dredged side-by-side, both working very hard. The daily recovery ranged from 2-to-5 ounces per day, depending upon how much bedrock we were uncovering (we were having to remove 10 feet of overburden and boulders to get to the gold).

We cleaned-up the high-grade portion of the sluice box every day and did a split. Once the gold was clean, we separated out 10% by weight for the dredge, and another 10% for the mining property. Then we split the remaining 80% right down the middle. This was what we had agreed upon. Sound right to you? It was! But on the days when we were recovering lots of gold, my 60% pile was so much larger than his 40% pile that there were always uncomfortable feelings. It is always that way!

Actually, I did my friend a huge favor. On his own, he would not have had access to a dredge or established rich gold deposit. But it is hard to keep all that in perspective when you are weighing out gold shares of different proportions on a scale. I could give you many, many examples of this just from my own experience.

This all comes into play more when large quantities of gold are being recovered, making the difference in piles even more noticeable. This is always the way it is with gold. Plan on it! If you don’t believe you would experience these feelings, it is only because you have not found high-grade gold, yet!

When forming partnerships, and the contributions are not all equal, it is common to allow 10% of the gross recovery to whoever owns the mining property. It is also common to allow 10% of the gross recovery to whoever owns the dredge. This is an exchange for putting up the capital for the main elements required to start a mining program.

If someone is putting up the money to keep everything going, rather than a percentage of the gross recovery, if you can swing it, it might be better to just agree to pay that money back (perhaps with a little interest) right off the top of the gold recovery. Then the guys who are doing all the work usually split up the balance. This isn’t always possible. Sometimes the guy putting up the money wants in on the gold production. All I can say is keep your obligations as small as possible. Because the more you have to give to someone else, the less chances there will be enough gold remaining to make your time and effort worthwhile.

SPLITTING FROM THE GROSS

Here is something really helpful: Unless it is just two guys sharing all the costs and rewards, it is much easier to work a deal where you are providing a percentage of the gross (total) gold recovery for each person’s contribution. Trying to work deals where you are going to first subtract the various operating costs makes the program more complex and opens up the chemistry to seeds of discontent. As an example, I would rather have 5% off the top of your total gold recovery than 10% of your net profit after you subtract all the things you decided to spend money on! If I just take mine off the top, I don’t have to get involved with the way you decide to spend money. Reversing that, I would rather not have you involved with the way I am spending money, either! There is a lot to be said about weighing up the clean-up, and giving everyone their share right there on the spot.

By the way, it goes without saying that good record-keeping is a must if you are providing a share to someone who is not present!

OVERMANNING AN OPERATION

One non-optimum way to set up a full partnership, is by teaming up in a small or intermediate-sized prospecting or mining program with a second person who does not have an additional dredge or surface mining gear to operate. One dredge or sluice can only process so much material in a single day. Two dredges of similar size, coordinated properly, ought to be able to double what one dredge can do by itself, as long as both operators are hard workers.

If you take on a partner using a small or intermediate-sized dredge, without also having a second dredge for him or her to operate, you will probably make less gold than you would if you just work alone. Since digging is slower, sometimes there is enough hard work for two people to keep a single sluicing operation operating efficiently.

There are exceptions to this, like when developing a high-grade gold deposit in deep streambed material where there are a lot of cobbles to be moved; enough to keep a helper productive full time without getting into your way. Another exception is when operating a large dredge, when it is a two-handed job to move the nozzle around. This creates the need for a helper to move the cobbles and boulders out of the way.

When two people are put to work on the same dredge, they need to be able to process at least twice as much volume of streambed material through the dredge, and recover twice the amount of gold. We have developed underwater team-work systems for this that contribute to productive production dredging programs. Otherwise, the arrangement can become inefficient, and the team might be better off operating two separate dredges, or take separate shifts on the same dredge.

In theory, you might figure that if one person can move a certain volume of material with a dredge or through a sluice, then two people working together on the same dredge or sluice ought to be able to process twice as much material. Sometimes this is true. If conditions are right for it, a well-orchestrated team under or above the water can process much more than double what either person could accomplish on his or her own. I have devoted a substantial discussion to underwater teamwork in Volume 2 of Advanced Dredging Techniques, so I won’t go into that here.

If there is not enough work to keep a second underwater person productive on a dredge, without the person cutting into the nozzle-man’s production and slowing him down, then it is not a good idea to put a second man there. What do I mean by cutting into the nozzle-man’s production? When a second person runs out of productive activity to keep busy, to stay busy, the person can start moving cobbles that are not ready to be moved. In doing so, streambed silt will be released into the water. Then if not immediately sucked up, water currents can cause that silt to spread around and cloud-out the hole. Then the nozzle-man must wait until the water clears up enough again that he can see what he is sucking into the nozzle. This is just one example of how a second person can actually slow down the production in a dredge hole.

As an example of an over-manned (and therefore underpaid) production dredging operation, I teamed up with two other guys one time in a sampling activity to locate a pay-streak. We found a very nice one which was sitting underneath about two feet of hard-packed material over top of some really rough and irregular bedrock. The pay-streak was about 45 feet wide; so there was no problem placing our two dredges side by side to clean up the gold.

We were each operating 5-inch dredges. Our partnership agreement was that after working together to locate some high-grade, we would develop the deposit side-by-side, keeping our clean-ups separate. I was running my own 5-incher and keeping all the gold that I found. The two of them teamed up on their 5-inch dredge and were splitting what they found equally between the two of them.

The streambed material was very hard-packed, and the water was moving pretty fast. A deep orange-colored silt in the material made it necessary to take apart the streambed in an orderly fashion, sucking the silt and material from the same spot that you were moving cobbles. Otherwise, that part of the dredge hole would be entirely clouded-out by silt, and you would have to wait for a half-minute or more before it would clear up enough that you could see what you were doing again. This is standard operating procedure in most dredging situations, anyway.

The hole we were dredging was so wide, that if I clouded myself out, their side would still remain clear enough that they could continue on dredging, and vice versa.

Since we agreed that each would keep what we separately recovered, and agreed that each could spend as many hours at it as we wished, the game was to produce like mad to dredge up as much gold as possible before the other guys recovered it. The friendly competition between us really spurred us on. Those were some hard-working guys and they surely kept me moving all the time, me knowing that they were dredging up all that gold as fast as they were. They had teamed up on their dredge and were going at it hot and heavy on the other side of the hole. But at the end of each day, my tailings pile was at least twice the size of theirs, and I usually had twice as much gold, too. Sometimes more!

In wonderment at this, I slowed down enough one day to have a look at what they were doing. Sure enough, they just kept clouding each other out. In 2 1/2-feet of material, there just was not enough work to keep two guys effectively busy on one dredge. I then went over and watched myself dredge, to see what a second man could do to help me get material through the nozzle faster, and there wasn’t much. I was pouring it through about as fast as it could be done most of the time.

The best bet for those guys would have been to split the day into two shifts: One starting at daybreak, and the other one ending at dark. In that way, each one of them would have ended up dredging about the same amount of gold that I dredged. As it was, they probably would have about doubled their gold intake if one of them did not dredge at all! This is something to keep well in mind when organizing a dredging operation.

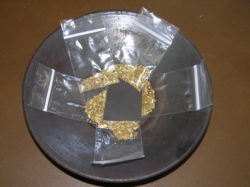

SPLITTING UP GOLD

My various partners and I have worked out a method of splitting up gold over the years which has always seemed to work out very well. On group ventures where everyone involved is getting some share of the gold we recover together, all recovered gold is deposited into a group collection jar. We pull out any and all pieces (nuggets) of gold that seem to be of extra value, and put those into a separate group jar. We split up the nuggets at the end of the venture, because there will be more of them then, so everyone is more likely to get a more fair portion of them. The rest of the gold (the fines and flakes) are split up on a regular basis. We do it every day if there is enough gold to make the effort worthwhile. Sometimes we classify the gold through window screen or 8-mesh, and measure up shares by weight of each size to each partner. If any partner is to receive some lower or greater percentage of the recovery, the person will receive it in both sizes. This is good, because each partner gets something back every day from the work he or she has invested.

At the end of the venture, when it is time to split up the nuggets and jewelry gold, we pick out the most extraordinary nuggets and set them aside for the moment. Then we make equal piles of all the remaining pieces of gold as equal by weight as possible, and equal by size and apparent value of the nuggets involved. Sometimes this can be a bit challenging, because each nugget is different. But when everyone is satisfied that the piles are all as equal in value that we are going to get them, we draw cards or tickets. Whoever has the highest card or first ticket gets to choose the first pile. The second-highest card gets to choose the second pile, and so on.

In our program, if one partner has some slightly-higher percentage of gold coming to him, he will usually receive the proper amount out of fines and flakes which were set aside for this purpose.

Then we take the most extraordinary nuggets that were set aside for last, and bid them off one by one-just like in an auction. Everyone involved in the partnership has an equal opportunity to bid up the amount of fine and flake-sized gold they are willing to pay for each nugget. Each nugget goes to whoever is willing to pay the most. The gold payments are directed into the group jar. Once all the nuggets have been sold off this way, the final gold from the jar is split up properly amongst all the partners according to our agreement.

While there are plenty of other ways to do it, this system has worked out very well, with no hard feelings amongst the partners, even though we often find very high-grade gold deposits with a lot of nuggets.

- Here is where you can buy a sample of natural gold.

- Here is where you can buy Gold Prospecting Equipment & Supplies.

- Dealing With Mining Claims

- Be Careful of the Deals you Make

- Integrity and Gold

- More About Gold Prospecting

- More Gold Mining Adventures

- Schedule of Events

- Best-selling Books & DVD’s on this Subject

By Dave McCracken

If you are going to get involved with a gold mining program, it would be wise to plan on the effect that gold will have on yourself & others!

I once knew a very knowledgeable guy who had spent a considerable amount of time studying the characteristics of gold. One of his conclusions was that each different kind of matter (the basic elements) emits a different vibration or wavelength; and that the vibration given off by gold is a wavelength of beauty in the aesthetic band. That gold is a very pure and beautiful substance is not in question!

I once knew a very knowledgeable guy who had spent a considerable amount of time studying the characteristics of gold. One of his conclusions was that each different kind of matter (the basic elements) emits a different vibration or wavelength; and that the vibration given off by gold is a wavelength of beauty in the aesthetic band. That gold is a very pure and beautiful substance is not in question!

But wait a minute: Beauty and value are perceptions or feelings that are experienced internally by human beings, not by the material substance. A person feels that gold is rich and beautiful when he or she looks at it closely and/or comes into intimate contact with it. So we are discussing here the way people commonly feel when they have some experience with gold – or sometimes just the concept of gold. In my own (quite extensive) experience, these common reactions are: (1) admiration (can be to the extreme or worship) of the pure, aesthetic quality and richness of the substance; and, (2) the desire to have some (or all of it) for yourself; and, (3) feelings of euphoria when you actually acquire some of your own gold, especially when you have made the initial discovery in some hidden place; and, (4) the fear or worry that someone might try and take your coveted prize away from you, or that you will not receive all of what is rightfully yours; and, (5) the impulse to take necessary steps to protect your interest from others.

Please understand that I am not saying that any of this is wrong. I am just saying that these are the normal sequence of emotional reactions that play themselves out when human beings search for and discover high-grade gold deposits. Add high-grade gold into the never-ending challenge of just normal human relations, and you are potentially in for a lot of drama, unless the various relationships are structured thoughtfully and managed carefully.

Gold is a very rich and alluring substance to deal with. No-matter how much gold a person has, there never does seem to be quite enough of it to completely fulfill one’s desire for more. Very much like an addictive drug, the more gold that you have, the more you realize that it is not nearly enough to fully satisfy your desires.

Perhaps gold does not affect everyone like this. But it certainly strikes most gold prospectors this way! To those prospectors out here who would disagree with this, my answer is that you just haven’t found enough gold yet to get your juices going!

Over the years, I have heard quite a few beginning gold prospectors declare that they are immune to all of this gold fever nonsense, saying they are just into gold prospecting for the money and economic reasons. Some say they are into it just for the fun and adventure – or for something interesting to do. But I say that you really cannot be certain of your immunity or how you will react until you uncover a rich gold deposit of your own. Usually, it is the nonbelievers who lose themselves the worst once substantial amounts of raw gold come into play in a gold mining project. My own conclusion is that nobody is immune. It is just a matter of how much gold that it takes to draw you out. Usually it does not take very much!

But even if you are one of the few people on this planet who are entirely free of the emotional impact from large quantities of raw, gold (very doubtful, or you probably would not be reading this article), if you are going to get involved with a gold mining program, it would be wise to plan on the effect that gold will certainly have upon others!

Let me first start by explaining that I am not a licensed attorney, so I am not able to give out legal advice. But I am an experienced prospector and miner, and I have had the opportunity to become involved, or stand on the sidelines and watch, many, many prospecting and mining ventures make a go at it. The views expressed in this chapter are not meant to give you legal advice. You should seek out a licensed attorney for that. My purpose here is to point out some of the different situations and relationships that you may encounter by circumstance as you move forward in a gold prospecting program of your own. How you ultimately deal with the different situations is your own business. My views provided here are expressed only to give you a look in advance at the types of relationships that are commonly involved with gold prospecting.

It is very important to be careful about who you partner up with when dealing with any amount of raw gold, especially when you are planning a venture with the intention of recovering large amounts of gold.

When negotiating the various dealings which you will have with partners and/or the owners of mining property, it is very important to be extra careful to make deals which all parties are agreeable to, and which all parties will be able to stick to. Agreements should be made very clear, in writing if possible, and always before the first high-grade gold deposit is located! Ultimately, the structure of an agreement should be put into place and finalized as the next step beyond discussion of the idea between the partners – before you begin organizing or capitalizing the project.

The process of putting agreements in writing forces the persons involved to address and agree upon important details that otherwise can be just brushed over in verbal discussions. A written agreement should reflect the complete final structure of the business relationship between the people involved, leaving earlier ideas or solutions behind, creating a record of all the final details. A written agreement allows anyone or everyone involved to go back for a reminder whenever it is necessary. Everyone directly involved should sign and receive a copy of the final agreement.

It becomes more important to have a written agreement to fall back upon once a high-grade gold deposit is being developed. Because that is usually when details become more important than they were before you found high-grade.

“Lets not worry about how we’re going to split up the gold; we’ll figure that out if and when we find any…” This might work alright on other things, but with gold it is very poor organization. Arrangements like this can very easily end up in dispute once high-grade has been discovered. Believe me: No one is looking at the world quite in the same way after a rich gold deposit is added to the picture!

“Lets not worry about how we’re going to split up the gold; we’ll figure that out if and when we find any…” This might work alright on other things, but with gold it is very poor organization. Arrangements like this can very easily end up in dispute once high-grade has been discovered. Believe me: No one is looking at the world quite in the same way after a rich gold deposit is added to the picture!

Additionally, any agreements that you make in a gold mining venture should be tailored to suit the valuable amounts of gold that you are going after. The reason for this is that if you make a deal which seems to be fair with everyone based upon developing a marginal pay-streak, and you then discover a very rich pay-streak that is producing commercial volumes of gold everyday, the deal may no longer be fair to everyone involved. But to try and revisit the inequity with your partners and to get everyone’s agreement on a new deal is almost impossible once large quantities of gold have been brought into play.

I learned this the hard way with an experience of my own. I had been dredging in an area for quite some time and had really put out a lot of time and energy to get familiar with it. Through dredging many sample holes, I was steadily working my way closer to a very large and high-grade pay-streak. But I did not know it at the time, because I had not found it yet. Man, I had gone through some real lean times prior to that! It was winter dredging with storm flows. This meant dredging in ice cold water that was also moving very fast. I was also trying to learn how to dredge at the time and trying to figure out how to find pay-streaks – all at the same time, while living in a tent out on my mining claim. And I was just starting to get pretty good at sampling. But I didn’t know that either. That is when an old friend of mine asked to come out and dredge with me for a few weeks. Well, he was a good friend, and his company sounded pretty good, so I encouraged him to come.

We worked out a 48/42% deal, with the larger share going to me. This seemed about right; because at the time my friend arrived, I was not finding paying quantities of gold, and it seemed like he ought to have a fair-sized split of the smaller amounts of gold that we found together. We agreed that I should receive a larger share, because it was my operation and he was just visiting.

We hit that rich pay-streak on the first sample hole of the first day that he arrived! It was not the first pay-streak that I had been into, but it certainly was by far the largest and best-paying – even after our split.

But the thing about it is that I was planning to put that sample hole there as my next project anyway. I had been working right into that pay-streak for months in my data collecting, hard work and sampling activities (that pay-streak and half-dozen others for that matter, which I did not know then, either). Man, were we into the gold; it was incredible!

I had invested the better part of a year of work into learning how to dredge and find that first big deposit. That was the gold which should have paid me off for all the hard times I had stuck through up until that point. Because of the deal I made with my friend, I ended up giving almost half of the gold to someone who took no part in the hard work of finding it. Sure, he helped clean it up. But cleaning up a rich pay-streak is the fun and easy part. The amount of time and energy it takes to get familiar with an area and learn how to find pay-streaks is worth a lot more. But this is something that my buddy would never have been able to fully appreciate, because he never had to go through it. To him it was just good fortune. For me to have tried to explain differently would have caused hard feelings. He would have figured that I was just trying to squeeze out of the agreement we made together. A deal is a deal. So he received his full split from the entire pay-streak and went away very happy. Me? I learned this lesson well: Make your partnership deals based upon the high-grade amounts of gold that you are going after and the fair exchange that should go to each person when that much gold is being recovered!

I had invested the better part of a year of work into learning how to dredge and find that first big deposit. That was the gold which should have paid me off for all the hard times I had stuck through up until that point. Because of the deal I made with my friend, I ended up giving almost half of the gold to someone who took no part in the hard work of finding it. Sure, he helped clean it up. But cleaning up a rich pay-streak is the fun and easy part. The amount of time and energy it takes to get familiar with an area and learn how to find pay-streaks is worth a lot more. But this is something that my buddy would never have been able to fully appreciate, because he never had to go through it. To him it was just good fortune. For me to have tried to explain differently would have caused hard feelings. He would have figured that I was just trying to squeeze out of the agreement we made together. A deal is a deal. So he received his full split from the entire pay-streak and went away very happy. Me? I learned this lesson well: Make your partnership deals based upon the high-grade amounts of gold that you are going after and the fair exchange that should go to each person when that much gold is being recovered!

I personally try to avoid forming full partnerships where the others involved receive some portion of the net profits – meaning the money that is left over after all expenses are paid. There are several reasons for this: (1) Putting yourself in a situation whereby you have to account for and gain the approval of others for every financial expenditure can really slow things down. This situation also creates the potential for internal disagreement and conflict, as even the simplest of things can get micro-managed by a committee. (2) I do not like to sell my share of the gold unless I have to. We have gotten around this in full partnerships by splitting off some portion of the gold recovery amongst the partners and only selling the amount of gold needed to pay expenses.

If you are going to do a full partnership arrangement whereby you will find yourself having to account (to others) for every expense you make, I suggest you keep the number of people you must account to as small as possible. The more opinions, the more potential conflict.

It is easier if you create limited partnerships whereby you just pay a fixed percentage of the gross recovery to those who are participating. This way can be a bit more risky, because fixed royalties do not allow you to pay your expenses first. But at least you will not have to devote a bunch of your creative energies accounting for and justifying to others about every move you make.

You will have to make your own choices about how to structure your deals with partners. My advice? Keep it as simple as possible!

It is not unusual for a commercial miner (on a small-scale), who already has all the gear, a place to mine and all the capital needed to keep the operation going; but he still needs a helper to dredge or mine with him. Very seldom do dredge helpers or small-scale miners get paid a wage or salary. They are almost always brought in for some percentage of the recovery. While deals vary, it is most common to see this kind of limited partnership come together whereby the helper(s) (junior partner(s)) receives 25 or 30% of the gross gold recovered – right off the top. That, by the way, is a big piece of the pie, considering that the mining property and mining gear should each be allocated 10% of the gross. This only leaves around 50% of the gross for the senior partner to pay operating expenses and repairs – and have something remaining for his own time and effort. Unless the operation is recovering a good deposit, sometimes the junior partner might be the only one making any money on this kind of deal. Still, you have to offer the junior partner enough of a cut to make him interested, or you will find yourself operating a commercial mining program all by yourself! One note on this: In the case where you would take on more than a single helper, it would be necessary to work out an additional agreement how they are going to split the 25 or 30% of the gross recovery.

Sometimes it works out better to set up a split on sliding scale, whereby the percentage that goes to a junior partner is higher when the amount of gold being recovered is less. This allows the junior partner to get an immediate return for his labor that is large enough to keep him interested. Then, when higher-grade pay-dirt is uncovered, the helper’s percentage gets scaled back. Not so much that he does not benefit from the additional good fortune. But enough to allow the senior partner (who invested all the time, work & money and took most of the risk) to be rewarded for his larger investment into the program. By the way, this kind of arrangement should always be worked out in advance of finding the higher-grade pay-dirt!

It is easier, by the way, to make a generalized deal that you are not particularly happy about, or in which all the details are not fully worked out, before you get into the gold. This is actually quite common. A few friends get together to go out and have a little adventure. They are not comfortable about discussing the gritty details of a business deal together, because they do not want to make anyone else mad at them. This is easy to do if you are not sure that you are going to find gold in paying amounts, anyway.

Then, after the gold is discovered, you really wish that you spent more time doing it right in the first place! I have seen this happen time and time again. It is so easy to talk glibly with your partners about how you will not have any trouble dealing with the gold, when “the gold” is still an abstract concept that you are doubtful will ever become a reality.

It is a whole different world when you are pulling pounds and pounds of beautiful, raw gold out of the river. You feel entitled to so much because of your contribution; your partners feel the same way because of their investments; and it all adds up to more than 100% of the gold! This is when the trouble really starts within the partnership. But it also is the time when the partnership should be turning up the production!

You can lose good friends over the smallest of disagreements when it comes to gold. I have watched it happen time and time again. It is better to work it all out right at the beginning; or if you cannot agree on the terms, just don’t do the project together.

For that matter, when dealing with substantial amounts of gold, it is tough enough to prevent dissension within a group even when the best and most carefully-structured deals are made with the most ethical of partners! This is just the way it is with gold! If you do not believe me, it is just because you have not found a rich enough gold deposit, yet.

A number of things need to be discussed when structuring how two or more people will come together in a mining venture: What part will each person play in the partnership? Who is going to be the project manager? How will you acquire the equipment needed for the operation? Where is the money going to come from to pay operating expenses and repairs? Who is going to handle the money? Exactly how and when is the gold going to be split up once you get into it? How are the nuggets going to be split up? Who, if anyone else, is going to be allowed to help develop any high-grade that is found? Who, if anyone else, is even going to be allowed to know about the pay-streak before it is cleaned up? How much time is going to be put into production? How much gold will be sold to handle expenses and repairs? Where the gold is to be stored before it is split up? How long will the partnership last?

Sometimes agreements need to be modified to cope with unanticipated circumstances or some other situation that requires an adjustment. There is nothing wrong with modifying an agreement as long as everyone involved goes along with it. When this happens, the written agreement should also be modified as soon as possible, with everyone signing the modified version. It is good administration of business to make sure the written agreement continues to accurately reflect the existing arrangement between the partners.

- Here is where you can buy a sample of natural gold.

- Here is where you can buy Gold Prospecting Equipment & Supplies.

- Dealing With Mining Claims

- Integrity and Gold

- Partnerships in Mining

- More About Gold Prospecting

- More Gold Mining Adventures

- Schedule of Events

- Best-selling Books & DVD’s on this Subject

By Dave McCracken

It’s much better to make your deal to work someone else’s mining property before you locate high-grade gold there!

Dealings with the owners of mining property should be accomplished in detail before a gold prospector or miner begins sampling around on those particular mining properties. This is for the gold prospector’s protection. I have seen it happen quite a few times where a prospector makes a generalized verbal agreement with a claim owner, whereby the prospector is given permission to prospect around on the property with the idea that they will make a “fair deal” if anything valuable is discovered. An arrangement like this might feel more comfortable than hammering out the details of a structured deal before gold is found. But things always look entirely different to everyone involved once a good pay-streak is located on the property!

Dealings with the owners of mining property should be accomplished in detail before a gold prospector or miner begins sampling around on those particular mining properties. This is for the gold prospector’s protection. I have seen it happen quite a few times where a prospector makes a generalized verbal agreement with a claim owner, whereby the prospector is given permission to prospect around on the property with the idea that they will make a “fair deal” if anything valuable is discovered. An arrangement like this might feel more comfortable than hammering out the details of a structured deal before gold is found. But things always look entirely different to everyone involved once a good pay-streak is located on the property!

Before a pay-streak is found, the mining claim does not necessarily carry any great amount of value to the bargaining table, because no one knows for sure if there is even any acceptable pay-dirt on the property. This is the best bargaining position for the gold miner! Under these conditions, a ten percent deal is very standard within the industry. That is 90% to the person doing the mining. What I mean by this is that a royalty of 10% of the gross (total) gold recovery will be directed to the owner of the property that is being mined.

Once a rich pay-streak is found, if a specific percentage deal has not already been established between the miner and property owner, the mining property suddenly becomes very valuable; and the mining claim owner is in a position to be asking for just about any percentage that he or she chooses. His position will now be that a treasure has been located on his claim, and all that is needed is for someone to come in and develop the deposit. And, of course, he is right!

I have seen it happen that a general deal was made between the gold prospector and a property owner “to be worked out in detail if pay-dirt is found.” Once the prospectors located the pay-streak, the claim owner believed he was entitled to 50% of the gross gold recovery. “After all, it is rich pay-dirt on my claim, and all you have to do is dredge it up: 50%–take it or leave it!” A property owner has the upper legal hand unless you make some kind of firm agreement that allows you the right to develop the gold deposit(s) which you discover on his property. So it is not a good idea to strengthen a property owner’s bargaining position by finding a pay-streak on his property before you finalize a percentage deal. Some final arrangement should be made before sampling is started, with the value of the mining property taken at face value at that time.

Just like in partnership deals, the arrangement with a property owner should be thoroughly discussed: Is the royalty going to be ten percent of recovered gold weight? Or, is it going to be ten percent of the complete range of nuggets, flakes, and fines? Is the split to be done on a daily basis? A weekly basis? Monthly? At the end of the season? Does the owner want to see the gold split up? How many dredges or sluices can you use on the property? Does the agreement allow you an exclusive right? Or might you find yourself competing with other gold miners on the same property? These are the types of things that need to be agreed upon during the very early stages.

The time frame is another thing that should always be discussed with a property owner. You should be comfortable that the property owner is not going to suddenly decide that your time is up on the claim, until after you have had a reasonable opportunity to mine out the high-grade deposit(s) that you have discovered there.

One of the richest gold deposits I located in my early years was turned over to one of my competitors by the claim owner, because my competitor made an offer to give the owner 20% of the gold recovery (from a deposit that I discovered). My deal with the claim owner was 10%, because no underwater deposits had ever been located there before my arrival. But because there was no discussion about my exclusive rights to what I discovered, or how long I could mine on the claim, when my competitor offered the owner a higher percentage, I was told I had to stop mining immediately and move on. That was real disappointing!

If you are not receiving an exclusive right to prospect and mine on the property, it is very important to work out an arrangement that at least allows you an exclusive right to develop any pay-streak that you are able to locate on the claim. Build some protection into the deal so you can be sure that a competitor is not going to be allowed to move in on your pay-streaks; or in the case of dredging, that no one else is to be allowed to move onto the claim up in front of you and cloud you out with their tailings.

Competitors come crawling out of the woodwork, once a rich gold deposit has been exposed. Expect that people are around who will try to figure out how to get some part of it, and they will be in there trying their hardest. The main idea behind structuring good agreements in advance is to minimize the amount of conflict and confusion which nearly always results when high-grade is brought into the picture. Well-structured deals with your partners and the property owner will usually allow you to get directly to the business of recovering gold.

It is not always necessary or possible to get agreements in writing with property owners. Some people simply do not like to commit themselves to anything in writing, and you cannot push it without causing the person to tell you to just get lost. This does not necessarily mean that these people are lacking in integrity. There are some people around who may consider that there is probably something wrong with your character if a hand shake is not good enough to seal a deal. You will have to find your own way through all this as you go along. However, the more you put at stake on a single mining property, the more important it is to have a written agreement that covers the main concerns.

These are the rules of the game that you will be playing. So it is wise to discuss them long enough, and thoroughly enough, to insure that everyone directly involved understands the essential details and are in full agreement with them.

In small-scale mining such as hand-sluicing and suction dredging, for the most part, at least in most of the places where I have operated for the past 30 years, the property owner usually receives ten percent of what a dredging operation recovers off of his property. I am talking about 10% off the top of the gross recovery.

I believe that it is excessive to pay more than 10% to a property owner, if I have to locate the pay-dirt myself. If the property owner can tell me right where the high-grade has already been located, and it is just a matter of my going in there and developing an established gold deposit, maybe a higher percentage might be justified, depending upon how rich the location is. Seeing is believing!

This mostly comes back to basic economics. You are paying for the mining and support equipment in the first place. You are going to pay the operating expenses, the repairs on your gear, and the living expenses for yourself and your crew. You are doing all the hard work. You are taking nearly all the risk. This is all on the possibility that there might not even be any high-grade on the property in the first place. Twenty percent is too much of a demand by a property owner under these conditions. But some will ask or insist. So I just walk away. It’s not like there isn’t plenty of proven mining property available to you these days!

One thing to keep strongly in mind while negotiating a mining property deal, is that the bigger piece of the pie you agree to pay the property owner, the less percentage of the pie that you will end up with as your own reward after all the other expenses are paid. This means that the more you agree to pay, the richer the gold deposit has to be in order for you to make anything for your effort. While giving away a higher percentage might not seem very important before you sample an area, just remember that there is a lot of pay-dirt around that will meet your minimum requirements on a 10% deal, which might not meet those very same requirements if you must pay 20% to the property owner.

Please keep this in mind: We are talking about giving away a portion of the gross (total) gold recovery. You will still have to pay yourself back for your investment in the mining gear, set up of the operation, repairs, operation expenses, and then split what is left over with the other guys who are helping you on the mining operation. Or perhaps they are also receiving a portion of the total gold for their participation. In a marginal pay-streak, the only person who might be making anything from all your hard work is the property owner! Or, after everything settles out, you might discover that everybody involved is making something, except you! So it can undermine the entire viability of your project if you agree to give away some higher percentage of your gross gold recovery to the property owner or anyone else. When someone asks for an additional 5% or 10% of your gross recovery, the number does not sound like very much. But in the end, that person could be making more gold from your mining operation than you are!

Some years ago, a person hired me to help him set up a production dredging operation in Cambodia. The guy was very excited about his prospects for success, based upon some very positive results that I obtained in a different area of the same country. But in order to gain all of the necessary permits and licenses over there in a hurry, he ultimately agreed to give away 90% of his gross gold and gemstone recovery to various officials in the country! And he had not even sampled for a deposit yet!

I did not find out about this until I arrived over there and got into a discussion with him about what percentage of gold he was planning to give the guys who would operate the equipment. He was asking me to help him arrange an experienced dredging team from the west. His idea of a partnership arrangement was to allow the crew to split 2% of the gross recovery. Here is an example of someone who liberally gave away the whole pie! Nice guy! Because he had already made his deal with the officials, they were unapproachable on the subject of a renegotiation. Since he could never get help from an experienced crew in exchange for such a low portion of the recovery, the operation never even got started. But the guy did end up losing all his gear and his full life’s savings trying to set it all up. Moral of the story? The more of the pie (especially the gross recovery-pie) that you give away to others, the less chance your operation will succeed, and the less chance the other pie-holders will get much out of it, either.

For a claim owner to ask, without a good and visible reason, for some unusually high percentage of the total gold recovery, he is inviting the dredgers to set their personal integrity aside and steal from him, and he most likely will end up receiving less than what would be reasonable. I have talked with a lot of miners over the years, and have found that for the most part, unreasonable property owners usually get treated unreasonably!

One good way to get yourself into all kinds of trouble, is to start yelling and screaming out your excitement for the whole world to hear when you have just made some kind of gold discovery. This is just as true even it is just a little find – or even if you are just goofing off! Those people who hear you and your excitement imagine gold finds and bonanzas probably far better than what you are actually into. That includes the property owner. If you make big noise about a small find, word is likely to get around, and the property owner might start wondering if he is being cheated!

On the other hand, if you find something nice and contain your excitement, it will be a pleasant surprise to the claim owner when you pay your royalty and he gets more than he or she expected. Please do not misunderstand me. I am not saying to withhold information from the property owner. I am advising you to not allow your own excitement and enthusiasm to create false perceptions which can thereafter get you into trouble.

When a person suddenly starts to do really good at something, there might someone else around who wants to make some trouble. This can be especially true when you start turning up high-grade gold deposits! It is better to not advertise for trouble!

When you are into a high-grade pay-streak, as difficult as it may be to do, it is good policy to keep pretty quiet about it until after you have finished cleaning it up. Then you can make all the noise you want to, as long as what you are saying is true. But while you are into it, if you do not tell anyone who doesn’t really need to know, you are less likely to become distracted by others who would like to get in on a piece of your action.

One other note on this: Since pay-streaks usually form in groups, where you find one, it is likely there are one or two more in the immediate vicinity. Perhaps the others are even richer! So there is something to be said about keeping things on the quiet side until some later time when there is not so much at stake.

Mining claims sell for just about any amount, depending upon how much value is being attached to them. Notice I didn’t say: “How much value they really contain!” Mining claims can sell for $200, or they can sell for a million dollars!

The best way to determine the actual value that a mining claim holds for you, is to thoroughly sample it. If you are thinking about buying a mining claim that you intend to dredge, it is not good enough to take samples up on the banks with a gold pan. It really takes going out there with your equipment and dredging sample holes to obtain an accurate idea of how valuable the claim is going to be to you as a gold dredger. It also is not good enough to dredge just one or two sample holes and stop there if you find pay-dirt. If you are going to pay a lot of money for the claim, it is wise to dredge more holes to see how long and wide the pay-streak actually is. Sometimes you can choose just the right spot to dredge (or the seller tells you where to dredge) a sample hole and put down in beautiful pay-dirt, only to find out later that it was a single deposit, or a very small pay-streak! This can be very misleading. I have seen it happen a few times!

If a claim owner is asking a lot of money for a mining claim, based upon his assurances that it is “very rich,” then he should have no objections to you doing some testing to see for yourself. It would be unreasonable for a seller to expect you to rely entirely upon his assurances. By the way, under the circumstances where someone is telling you how much gold they dug or dredged from the property, ask immediately to see the pictures! What, they got all that gold and didn’t bother to take any pictures? Seems unlikely to me! If there are pictures, match up the background to make sure it is the same property?

Watch out for the seller who plays it up real big and tries to get you so excited about all the gold you are going to recover, that you do not feel the need to do any testing! “Oh man, this claim is so hot that it kills me to sell it—but I’m too old to work it and I need the money …” This is where the con-man is going to try and get you.

When dealing with mining claims, if it is worth a lot of money, then it is definitely worth a lot of sampling first!

Another way that you can get stung on a mining claim deal, is by buying one from someone who does not really own it, or by paying royalties to someone who has given you permission to mine on the claim, but who does not really own it.

With some research, you can locate any active mining claim in the County Recorder’s Office and the Bureau of Land Management records, and find out who really owns it and make sure the yearly paperwork has been kept up. At the same time, you can research to see if anyone else has filed a mining claim over the very same location. If two or more people have filed mining claims over the same ground, future conflicts are likely, so it may be wise to look for another mining claim.

Perhaps it is not necessary when you first make a percentage deal over a claim with a person who apparently owns it. But if you get into large amounts of gold, it could be worth the little time it takes to verify who the actual owner is.

Or, rather than buy a mining property, perhaps the better idea is to join up with a prospecting organization that freely makes mining property available to its members. You can turn up a large number of such organizations simply by doing some word searches on the Internet. Just as an example, our organization makes 60+ miles of gold-bearing property available to our members at the cost of just a small fraction of what a single mining claim would cost to buy in the very same area.

- Here is where you can buy a sample of natural gold.

- Here is where you can buy Gold Prospecting Equipment & Supplies.

- Be Careful of the Deals you Make

- Integrity and Gold

- Partnerships in Mining

- More About Gold Prospecting

- More Gold Mining Adventures

- Schedule of Events

- Best-selling Books & DVD’s on this Subject